BlackRock, the world’s largest asset manager, has agreed to buy Bayo Ogunlesi’s Global Infrastructure Partners (GIP) for about $12.5 billion—in cash and stock.

The deal, BlackRock’s largest in more than a decade, was disclosed in a statement on Friday.

BlackRock said GIP’s acquisition aligns with the vision of Laurence Fink, its chairman and chief executive officer (CEO), to transform the firm into a key player in the growing market for private and alternative assets.

According to the statement, BlackRock is to pay $3 billion in cash and $9.5 billion in shares (about 12 million shares) for GIP’s $100 billion infrastructure portfolio.

The deal is expected to close by the third quarter (Q3) of 2024.

BlackRock said it will also appoint Ogunlesi, GIP founding partner, chairman, and CEO, to the board at the next scheduled board meeting after the close of the deal.

“The combination of GIP with BlackRock’s highly complementary infrastructure offerings creates a comprehensive global infrastructure franchise with differentiated origination and asset management capabilities,” the firm said.

“The over $150 billion combined business will seek to deliver clients market-leading, holistic infrastructure expertise across equity, debt, and solutions at substantial scale.

“Marrying the proprietary origination and business improvement capabilities of GIP and BlackRock’s global corporate and sovereign relationships provides a platform for diversified, large-scale sourcing to support deal flow and co-investment opportunities for clients. We believe bringing GIP and BlackRock together will deliver to clients the benefits of broader origination and business improvement capabilities.”

Commenting on the acquisition, Fink said the deal is “one of the most exciting long-term investment opportunities.”

“We believe the expansion of both physical and digital infrastructure will continue to accelerate as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors,” BlackRock’s CEO said.

“I’m delighted for the opportunity to welcome Bayo and the GIP team to BlackRock, and happy to announce our plans to have Bayo join our board of directors post-closing.

“Bringing these two firms together will create the infrastructure platform to deliver best-in-class investment opportunities for clients globally, and we couldn’t be more excited about the opportunities ahead of us.”

‘CREATE WORLD’S PREMIER INFRASTRUCTURE INVESTMENT FIRM’

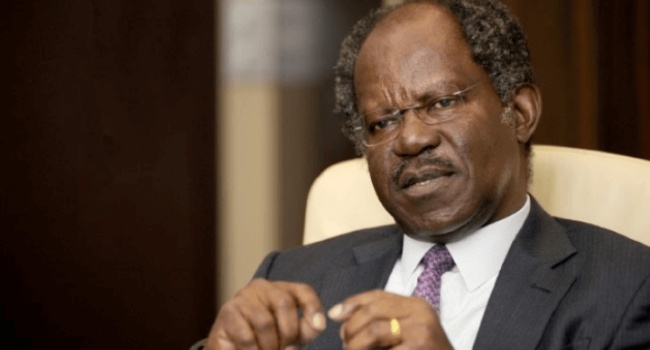

On his part, Ogunlesi said he believes the deal can create the world’s premier infrastructure investment firm.

“I’m excited about the power of this combination and the prospect of working with Larry and his talented team,” Ogunlesi said.

“We share with BlackRock a culture of collaboration, client focus, investment partnership, and commitment to excellence. Investors have adopted private infrastructure investing for its ability to provide stable cash flows, less-correlated returns, and a hedge against inflation.

“This platform is set to be the preeminent, one-stop infrastructure solutions provider for global corporations and the public sector, mobilising long-term private capital through long-standing firm relationships.”

Ogunlesi, 70, launched GIP in 2006 with backing from General Electric Co. and Credit Suisse, and its portfolio companies have combined annual revenues of more than $80 billion.

The firm scaled its global equity flagship series, with the most recent fully invested flagship fund in 2019 surpassing $22 billion.

He currently serves as Goldman Sachs Group Inc.’s lead director.