World Bank says developing countries spent a record $443.5 billion to service their external public and publicly guaranteed debts in 2022.

According to the bank’s 2023 International Debt Report, released recently, the overall debt-servicing costs for the 24 poorest countries are expected to balloon in 2023 and 2024 — by as much as 39 percent.

Bretton Woods institution said debt-service payments — which include principal and interest — increased by 5 percent over the previous year for all developing countries.

The organisation also said the external debt stock of low- and middle-income countries (LMICs) decreased by 3.4 percent, from $9.3 trillion in 2021 to US$9 trillion in 2022.

The report added that the 75 countries eligible to borrow from the World Bank’s International Development Association (IDA) — which supports the poorest countries — paid a record $88.9 billion in debt-servicing costs in 2022, noting that over the past decade, interest payments by these countries have quadrupled to an all-time high of $23.6 billion in 2022.

The report also revealed that from 2012 through 2022, IDA-eligible countries increased their external debt by 134 percent, outstripping the 53 percent increase they achieved in their gross national income (GNI).

“The external debt stock of countries eligible for IDA resources, however, increased by 2.7 percent in 2022, to an all-time high of US$1.1 trillion,” the report reads.

Speaking on commitments from creditors, the World Bank said new commitments to IDA-eligible countries from bilateral creditors decreased by 30 percent to $14.2 billion.

“By contrast, new commitments from multilateral creditors increased by 4 percent to $43 billion. And new commitments by the World Bank (including IBRD and IDA lending) accounted for 58 percent of total multilateral creditor commitments, increasing by 8 percent in 2022 to an all-time high of $25.2 billion,” the global bank added.

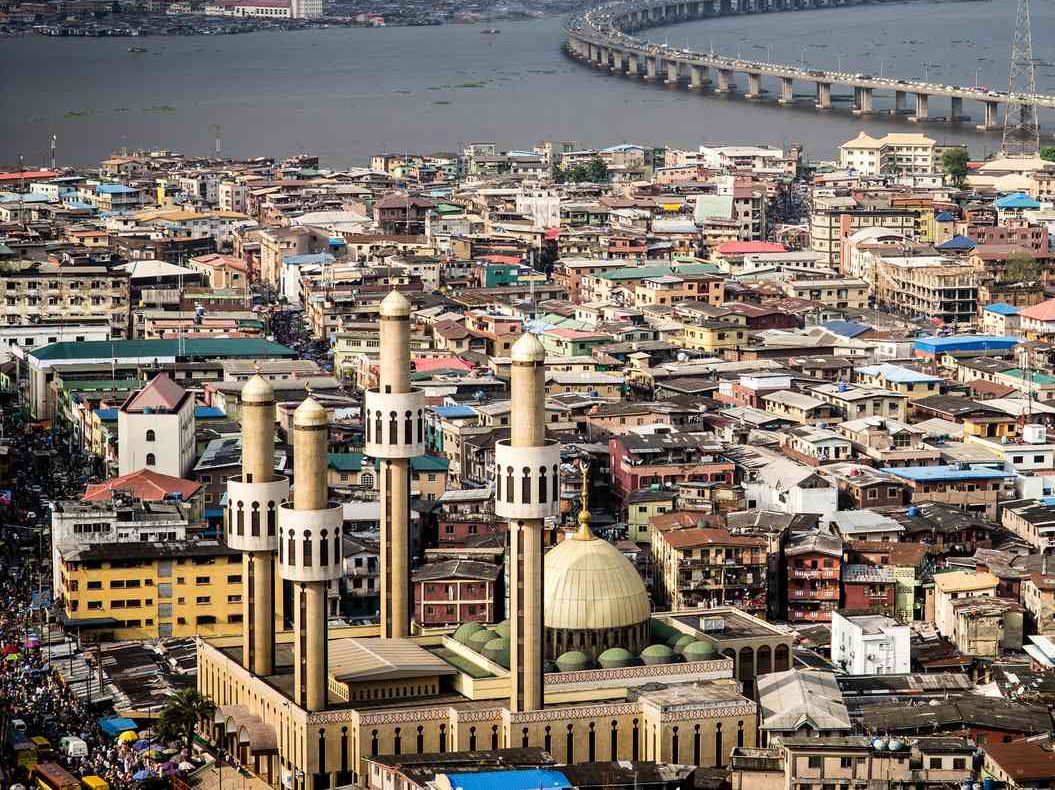

“Nigeria and Tanzania were the top recipients of new financing from the World Bank in 2022, at US$2.9 billion and US$2.7 billion, respectively.”

The report said IDA-eligible countries have spent the last decade adding to their debt at a pace that exceeds their economic growth — “a red flag for their prospects in the coming years.”

NIGERIA’S EXTERNAL DEBT STOCK

According to the World Bank, Nigeria’s total external debt stock stood at $98,335 million for 2022. This comprises public and publicly guaranteed debt, by creditor and creditor type in 2022, including IMF credit.

A breakdown of the figure showed the percentage of each creditor as; private (41 percent), bilateral (12 percent), and multilateral (47 percent).

INTEREST RATES AND DEFAULTERS

The international body said surging interest rates have intensified debt vulnerabilities in all developing countries.

“In the past three years alone, there have been 18 sovereign defaults in 10 developing countries — greater than the number recorded in all of the previous two decades. Today, about 60 percent of low-income countries are at high risk of debt distress or already in it,” World Bank said.

“Interest payments consume an increasingly large share of low-income countries’ exports. More than a third of their external debt, moreover, involves variable interest rates that could rise suddenly.

“Many of these countries face an additional burden: the accumulated principal, interest, and fees they incurred for the privilege of debt-service suspension under the G-20’s Debt Service Suspension Initiative (DSSI).”

According to the report, the stronger US dollar is adding to the difficulties of these countries, making it even more expensive for them to make payments.

The bank said a further rise in interest rates or a sharp drop in export earnings could push them over the edge.

“Through IDA, the World Bank provided $16.9 billion more in new financing for these countries than it received in principal repayments — nearly three times the comparable number a decade ago,” the report said.

‘QUICK ACTION BY GOVERNMENTS’

Commenting on the findings, Indermit Gill, the World Bank Group’s chief economist and senior vice-president, said record debt levels and high-interest rates have set many countries on a path to crisis.

“Every quarter that interest rates stay high results in more developing countries becoming distressed — and facing the difficult choice of servicing their public debts or investing in public health, education, and infrastructure,” Gill said.

“The situation warrants quick and coordinated action by debtor governments, private and official creditors, and multilateral financial institutions —more transparency, better debt sustainability tools, and swifter restructuring arrangements. The alternative is another lost decade.’’

Also speaking, Haishan Fu, chief statistician and director of the World Bank’s development data group, said the first step in avoiding a crisis is having a clear picture of the challenge.

He said when problems arise, clear data can guide debt restructuring efforts “to get a country back on track towards economic stability and growth”.

Fu said debt transparency is the key to sustainable public borrowing and accountable, rules-based lending practices vital to ending poverty on a livable planet.