FAAC shares N1.298tr to Fed, States, LGAs for September 2024

The Federation Accounts Allocation Committee (FAAC) has distributed N1.298 trillion to the Federal, State…

N’assembly considering bill seeking to increase VAT from 7.5% to 10% by 2025

The national assembly is considering a bill proposing an increase in the…

FG has finalised plan to implement zero VAT on imported pharmaceutical products – Minister

Tunji Alausa, minister of state for health and social welfare, says the…

FEC approves bill seeking amendment of company income tax

The federal executive committee (FEC) has approved the economic stabilisation bill seeking…

Reps direct GTB to refund VAT Commission collected for 8 years

The House of Representatives Public Accounts Committee (PAC) has directed Guaranty Trust…

Edun hits back at Atiku, says VAT remains at 7.5%

Wale Edun, minister of finance, says the federal government has not increased…

Nigeria generated N1.5trn from VAT in Q2 2024, up by 9.11% from Q1 – NBS

The National Bureau of Statistics (NBS) says the country generated N1.56 trillion as value-added…

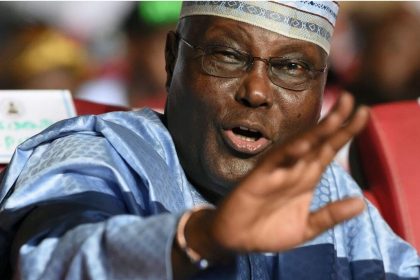

Atiku decries proposed VAT increase, says it’s ‘regressive, punitive policy’

Atiku Abubakar, former vice-president, has decried plans by the current administration to…

Oyedele committee proposes exemption of businesses with N50m annual turnover from VAT

Taiwo Oyedele, chairman of the presidential fiscal policy and tax reforms committee, says…

Traders desperate to sell off old stock as FG implements short-term open borders

Wholesale marketers are desperate to sell off their old stocks and products…